Donation Receipt For Non Profit

Here are the steps to follow for writing a donation receipt letter. Save Time Money - Start Now.

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

A charitable donation receipt is a letter email message or receipt form notifying a donor that their gift has been received.

. Microsoft Word docx Cash Donation Receipt Template. Build Receipts Other Transaction Records Free - Easy-to-Use Platform. Donation receipts serve as legal documents or legal requirements for non-profit organizations.

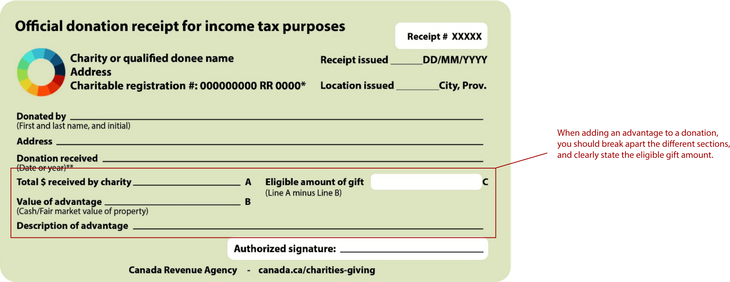

Non-monetary donations over 500 in value require a donation receipt and a record of how and when your nonprofit organization acquired the items. 501 c 3 charity donation receipt is written by the charity organization upon receiving contributions worth 250 and above. Original Non Profit Donation Receipt Letter Template For Non Cash Source.

Ad No Matter Your Mission Get The Right Nonprofit Donation Tools To Accomplish It. Ad NY Donation Receipt More Fillable Forms Register and Subscribe Now. Plus theyre using their receipt to drive potential corporate matching gifts.

Review the Best Nonprofit Donation Tools for 2022. When the IRS asks for these documents and the organization is unable to present them they can be charged with a penalty depending on the cause of the donation. Any gift over 250 must be recognized with a receipt.

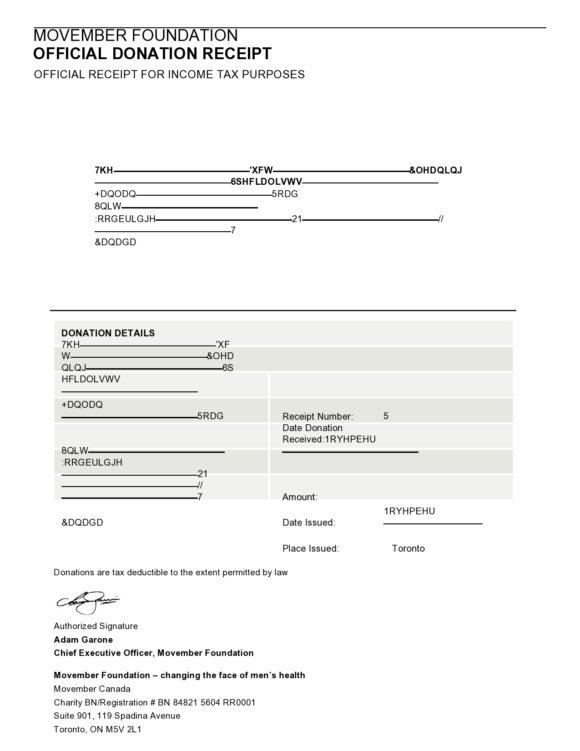

The receipt is important to the donor who gives out cash vehicle or personal property and wishes to have a tax deduction on the donation. A 501c3 Donation Receipt is a written document stating or acknowledging that a donation has been made and received from one party to another party an individual or an entitynon-profit. You may add your organizations tagline or logo in order to make the letter look more professional.

PdfFiller allows users to edit sign fill and share all type of documents online. The Leading Online Publisher of National and State-specific Legal Documents. Charitable donation receipts contain any and all information regarding the gift donor name organization name gift amount gift type etc.

Non-cash donations under 500 in value require a written donation receipt unless the items were put in unmanned donation bins like the Goodwill drop off boxes. Start with the heading Likewise most letters this letter also starts with heading. Currently we are only able to send automatic receipts for PayPal donations.

Our process converts a donation to a PDF receipt which lands in your donors inbox within seconds. Our site shows when receipts are sent viewed by your customer and accepted or declined. The 25000 Rule For Donation Receipts.

Our charitable donation receipt portal streamlines the fundraising process by automatically creating and issuing receipts for all types of donations. They would also have to track which charity they gave to on their own. The heading includes the date when you wrote the letter and the recipients address.

Ad Create Edit Sign Receipt Documents Online Today - Fast Easy Free. Campaigns receipt is designed to provide their donors with all the information they need to use their receipt for their tax purposes while making sure their donors feel appreciated and that their donation is making an impact. Ad Download Or Email ACS Forms More Fillable Forms Register and Subscribe Now.

The 25000 donation rule simply states that for donations up to 25000 the donor can simply use a canceled check bank statement or other documentation for proof of the donation.

Free Donation Receipt Templates Silent Partner Software

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

Donation Receipt Template Download Printable Pdf Templateroller

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Free Donation Receipt Templates Samples Word Pdf Eforms

Why How And When To Issue Charitable Donation Receipts

Nonprofit Donation Receipt Letter Template

Nonprofit Donation Receipts Everything You Need To Know